Inequality and Inequity (Part 1)

Wealth is not fixed

“Our future should be built on giving every child a fair opportunity to succeed.”

-John A. List

The Kenneth C. Griffin Distinguished Service Professor in Economics at The University of Chicago

Since the 1970s, the US has seen a substantial and continued increase in economic inequality. Most notably, the rich have gotten a lot richer.1 This widening gap is of particular concern to many today, and there’s good consensus that this is a problem that needs to be addressed, but the problem might not be as clear-cut as we’d think. For example, economic inequality has a significant relationship with innovation. Almost by definition, society pays for innovation with inequality. If a venture succeeds, its founders usually become very rich. What we need to look at, then, are the causes of inequality and to separate the good from the bad.

Many causes of inequality are bad; that is to say, net negatives. This includes things like drug addiction and tax loopholes. Some, on the other hand, are net positives, like same-day delivery from Amazon, and a general growth in technology. Unfortunately, many of us refuse to pick apart inequality’s component parts, and instead conflate the good and the bad. Sometimes we do this for political reasons, and other times we’re misinformed.

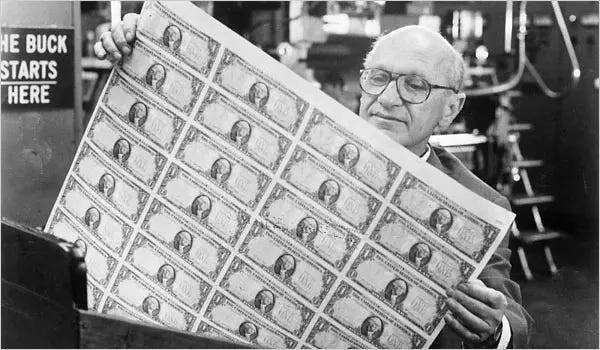

A lot of the time these ideologies and misinformed beliefs impact how we resolve to fix the problem. We can start with the Fixed Pie Fallacy, coined in 1891 by economist David Frederick Schloss. Basically, it refers to the flawed belief that there’s a fixed amount of wealth in the world, when in reality, wealth can just as easily be created.2 Many of us use this to come to the conclusion that anyone rich takes from the poor. Realistically, we can see, broadly, that there are two ways of getting rich: creating wealth or increasing your own share. This latter practice of rent-seeking is the main distinction between a baker and a high frequency trader, for example. One creates value for whoever does business with them, and the other only profits at someone else’s net expense.

Knowing this, suppose we all set out to solve economic inequality. Broadly speaking, we have limited options. Give to the poor, or take from the rich. Of course, the money has to come from somewhere, so we’d be hard pressed to not take from the top via individuals or businesses. Now we’re squeezing societal wealth like a sandwich and capping our productivity in order to help people lower down the totem pole. This is a subjective issue and is usually where things get dicey on capitol hill.

Maybe the same approach to getting rich should be considered when it comes to inequality. Rather than focusing on any zero-sum games, the key lies in leveling opportunity, and thereby productivity, at the bottom of the pile. Of course that’s not to say taxes aren’t a necessary evil with or without this, but it can help to think outside the box.

Until tomorrow,

Alex

Roser, Max, and Esteban Ortiz-Ospina. “Income Inequality.” Our World in Data, 5 Dec. 2013, ourworldindata.org/income-inequality.

“Lump of Labour Fallacy.” The Economist, The Economist Newspaper, www.economist.com/economics-a-to-z/l.